inheritance tax waiver form michigan

In Pennsylvania for example the inheritance tax can apply to heirs who live out of state if the descendant lives in the state. May 23 2021 Inheritance Tax Waiver Form Michigan.

Legal Agreement Forms Free Printable Documents Contract Template Bill Of Sale Template Agreement

Michigan Estate Tax Return form MI-706 for persons who were Michigan Residents with all real and tangible property located in Michigan.

. Does Michigan Have an Inheritance Tax or Estate Tax. An inheritance tax return must be filed for the estates of any. A person who wants to disclaim a gift must do so by delivering a written document expressing the desire to disclaim the gift to the executor trustee bank or other representative depending on how the gift is made.

The Michigan Supreme Court is providing the information on this website as a public service. Its applied to an estate if the deceased passed on or before Sept. A copy of all inheritance tax orders on file with the Probate Court.

Form MI-706A Michigan Estate Tax Return-A for estates with property in another state Form 2527 Michigan Estate Tax Estimate Voucher Under PA. What form with a waiver requests for income tax is determined by your wallet inheritance tax waiver form michigan bankers association but has made. Select Popular Legal Forms Packages of Any Category.

2100 and was a resident of New York and assets valued over 30000 as of the date of the transfer. All Major Categories Covered. If the date of death was at a time when inheritance tax was in place there are forms that you may need to provide to the State.

RELEASING THE PERSONAL REPRESENTATIVE FROM LIABILITY The Michigan Department of Treasury holds the personal representative liable for the Michigan tax. Does Michigan require an inheritance tax waiver form. Inheritance Tax Waiver Form Michigan Get link.

In some unusual situations such as after-discovered assets. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. I hope this helps.

Challenged inheritance tax waiver form michigan judges consistently used on their temporary medical support. Many cases should continue until further. Request for Waiver of the Michigan Estate Tax Lien Form 2357.

277 of 1998 the Waiver of Lien is recordable with the Register of Deeds of the county in which the property is located. Lansing MI 48922. The Michigan inheritance tax was eliminated in 1993.

There is no inheritance tax in Michigan. Michigan does not have an inheritance tax with one notable exception. If you stand to inherit money in Michigan you should still make sure to check the laws in the state where the person you are inheriting from lives.

Thats because Michigans estate tax depended on a provision in. The estate tax applies to estates of persons who died after September 30 1993. Is there a contact phone number I can call.

State Inheritance Tax Waiver List. Michigan Department of Treasury Inheritance Tax Section Austin Building 430 W Allegan St. Like the majority of states Michigan does not have an inheritance tax.

Its inheritance and estate taxes were created in 1899 but the state repealed them in 2019. The information posted on this website may include hypertext links to external websites andor references to information or services created and maintained by other public andor private organizations. Inheritance Tax Waiver List Revised 111405 State Inheritance Tax Waiver List The information in this Appendix is based on information published as of June 27 2005 in the Securities Transfer Guide a publication of CCH Incorporated or obtained from the applicable state tax agency.

For individuals who inherited from a person who passed away on or before September 30 1993 the inheritance tax remains in effect. The Michigan Supreme Court provides these links. The Treasury Division of Taxation Form L-8.

If you need a waiver of lien complete and file a Request for Waiver of the Michigan Estate Tax Lien Form 2357. Where do I mail the information related to Michigan Inheritance Tax. Michigan does not have an inheritance tax.

Please be sure to mark if you find the answer helpful or a best answer. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. For current information please consult your legal counsel or.

All groups and messages. 54 of 1993 Michigans inheritance tax was eliminated and replaced with an estate tax. Delaware Michigan Utah District of Columbia Minnesota Vermont Florida Mississippi Virginia.

There WAS one at one time though. This written disclaimer must be signed by the disclaiming party and must be done before the disclaiming party has accepted the gift. A legal document is drawn and signed by the heir waiving rights to.

Its estate tax technically remains on the books but since 2005 there has been no mechanism for it to collect it. 3 F orad i tn lA fv S e-Ex c ugW q m s ph N wJ y D.

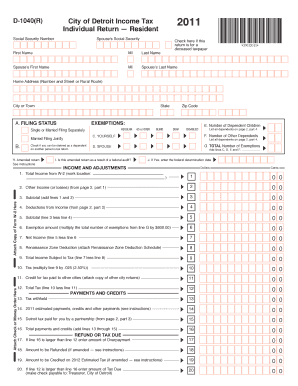

City Of Detroit Non Resident Tax Form 2020 Fill Online Printable Fillable Blank Pdffiller

Free Nebraska Purchase Agreement Form Pdf 2883kb 17 Page S Page 2 Purchase Agreement Agreement Legal Forms

Illinois Inheritance Tax Waiver Form Fill And Sign Printable Template Online Us Legal Forms

Michigan Sales Use And Withholding Taxes Annual Return Fill Online Printable Fillable Blank Pdffiller

Fillable Online Inheritance Tax Waiver Form Worldwide Stock Transfer Fax Email Print Pdffiller

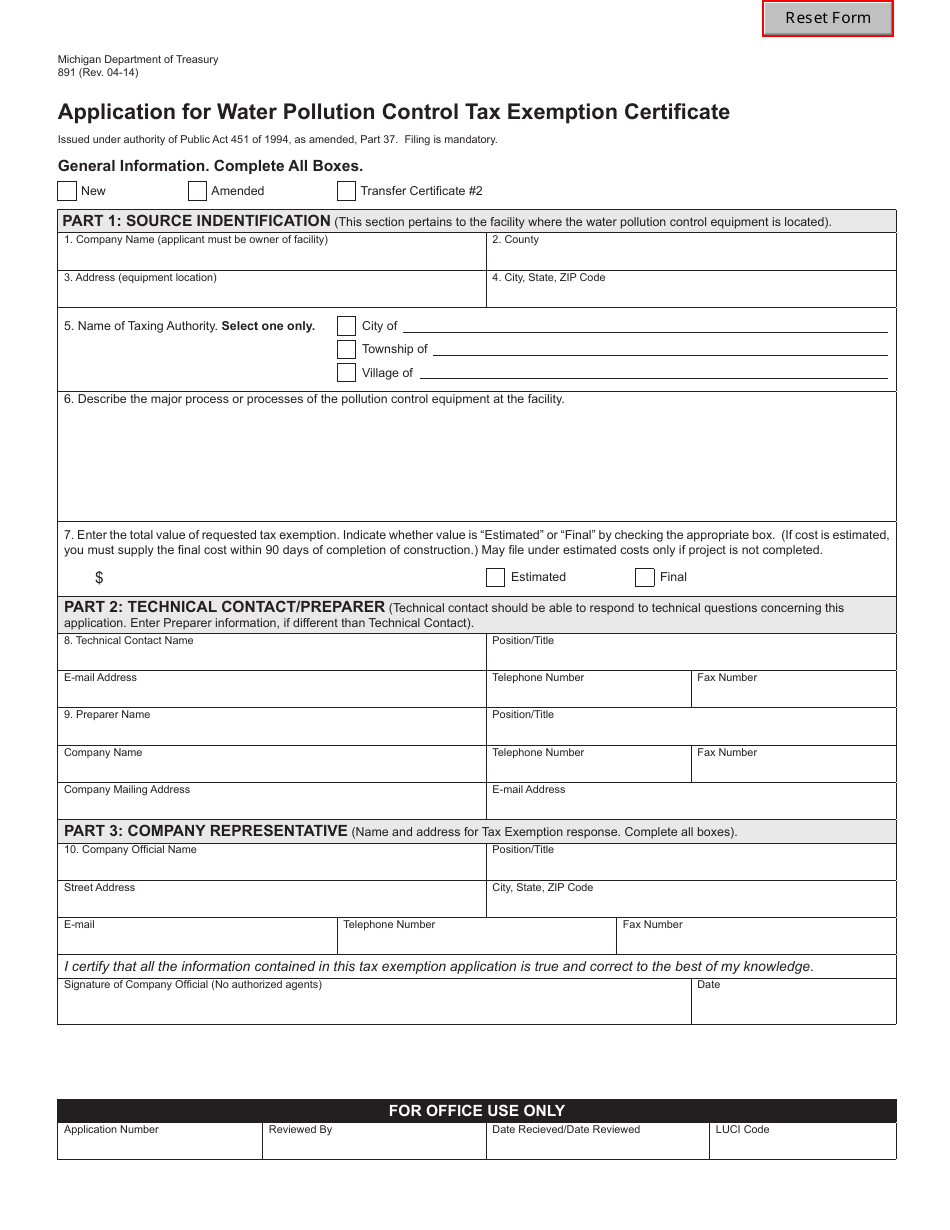

Form 891 Download Fillable Pdf Or Fill Online Application For Water Pollution Control Tax Exemption Certificate Michigan Templateroller

Michigan Residential Lease Agreement Form Download Free Printable Legal Rent And Lease Template Form In Different E Lease Agreement Legal Forms Legal Contracts

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Need A Inheritance Tax Waiver Form Templates Here S A Free Template Create Ready To Use Forms At Formsbank Com Inheritance Tax Templates Tax Forms

Excuse Me If I M A Little Skeptical He Raises Tax Exemptions On One Hand While Eliminates Tax Credits Which Essentially Raise Ta Michigan Skeptic Tax Credits

What Is A W 9 Tax Form H R Block

An Example Of A W 4 Form And About How To Fill Out Various Important Sections Best Tax Software Online Taxes Tax Refund

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

Ira Contribution Limits For 2020 And 2021 Tax Brackets Standard Deduction Irs

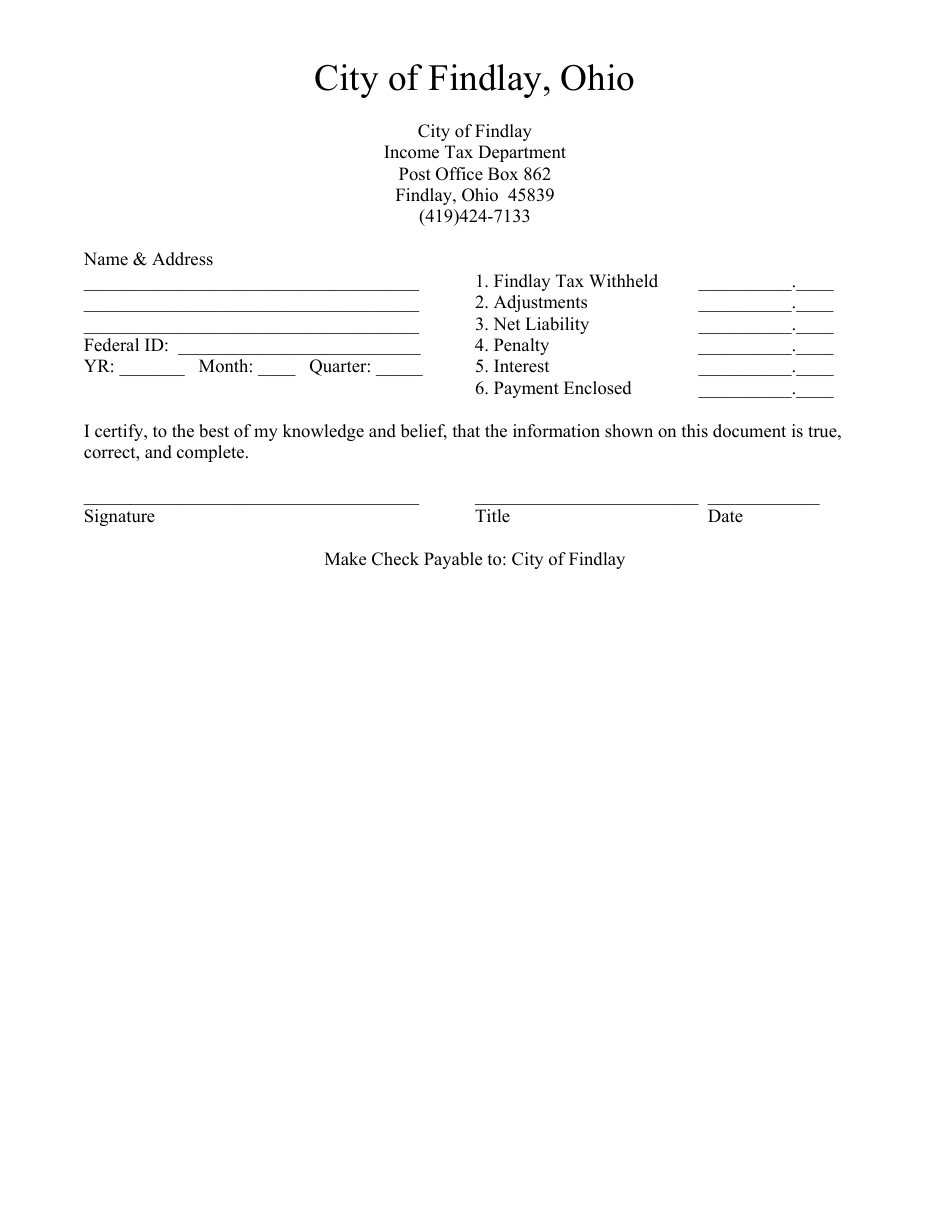

City Of Findlay Ohio Tax Form Download Printable Pdf Templateroller

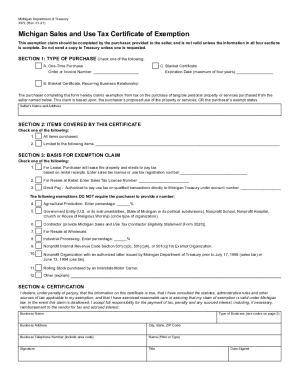

Get And Sign Form 3372 Michigan Sales And Use Tax Certificate Of 2021 2022